Invest Smart And Save On Tax!

Improving one’s financial outlook is possible when investing optimally and taking the tax implications of these investments into consideration. This is especially relevant in today’s times with the financial impact of the Covid-19 pandemic; we need to make sure that the money we have available are being put to optimal use.

Albert van der Linde, Wealth Manager from the Securitas Financial Group, explains the tax benefits and rules of retirement funds and tax-free saving accounts.

Retirement Annuity Fund

The Retirement Annuity Fund is a savings vehicle that offers you a flexible, tax-efficient way to save for retirement. You may only access your money at retirement. You cannot retire from the Fund before the age of 55 except if:

• You are permanently disabled

• You emigrate from South Africa and your emigration is recognized by the South African Reserve Bank.

• Your investment value is less than R15000.

• You leave South Africa at the end of a work visa or visitor’s visa, as contemplated in the Income Tax Act

Accessing Your Money

Retirement (after age 55):

A maximum of one-third of the market value of your investment in the Fund can be taken as cash. The remainder must be used to purchase a compulsory pension-providing vehicle such as a Living Annuity. If the market value of your investment at retirement is equal to or less than R247 500 across all Retirement Annuity investment accounts, the full amount can be taken as cash. Amounts taken as cash are subject to tax.

Withdrawal (before age 55)

If the market value of your investment across all Retirement Annuity accounts is R15000 or less and you are not making any recurring debit order contributions, you may make a full cash withdrawal. Amounts taken as cash are subject to tax. If you make a withdrawal before retirement, the lump sum you are allowed to take tax free at retirement will be decreased by the amount you withdraw.

Death prior to retirement

If you die before retirement the trustees will determine how your investment should be allocated to your dependents/nominated beneficiaries. Those who receive a benefit can choose to receive a cash lump sum and/or to receive the death benefit as an annuity. If no dependents/nominated beneficiaries are found, the death benefit will be paid to your estate as a lump sum. Amounts taken as cash are subject to tax.

Permanent disability prior to retirement

The Trustees need to approve this application for early retirement based on medical evidence obtained at your cost. A maximum of one-third of the market value of your investment can be taken as cash. The remainder must be used to purchase a pension-providing vehicle such as a Living Annuity. If the market value of your investment at the time of your early retirement is equal to or less than R247 500 across all Retirement Annuity investment accounts, the full amount can be taken as cash. Amounts taken as cash are subject to tax.

Tax deductions on contributions to retirement annuities are limited to the greater of 27.5% of taxable income or remuneration (excluding any retirement fund lump sum, withdrawal and/or severance benefits) per year, subject to a maximum of R350 000 per year. You can carry any excess contributions over to the following tax year.

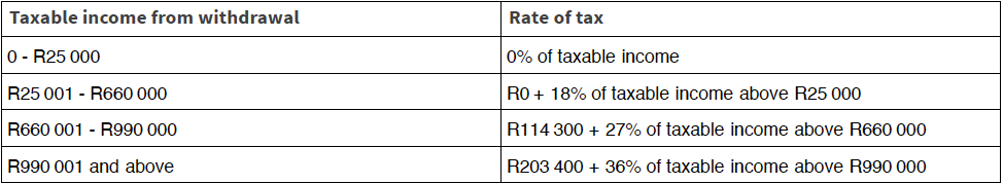

The first R25 000 of your pre-retirement withdrawal is tax free. This only applies once in your lifetime across all your retirement funds and is aggregated over your lifetime.

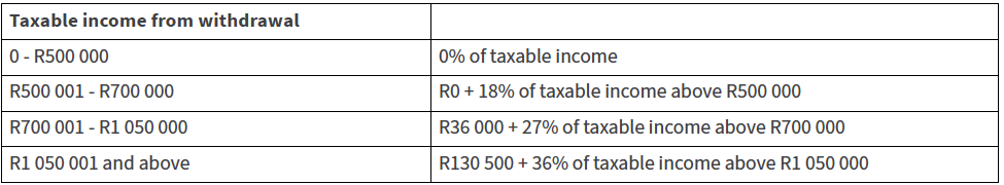

Tax on retirement or death before retirement

In addition, the following portion(s) of the cash lump sum will be tax-free:

• Contributions to the Fund that were not tax deductible when contributed

• Contributions made to a public sector fund (e.g. The Government Employees Pension Fund) on or before 1 March 1998

Tax Free Savings Accounts

Tax Free Savings defined:

Tax free savings is a class of unit trusts that allows South African residents to earn 100% tax free growth on their contri¬butions to these unit trusts. All returns earned on the invested contributions are free from tax on interest, capital gains and dividends. This can be invested directly in cash instruments or other unit trust investments on most investment platforms.

Investment Specifications:

Contributions:

• Most platforms has a minimum contribution amount of R500 per month and a maximum of R3000 per month. Contributions are limited to R36 000 per year (either via a lump sum or debit order) per individual, and a maximum contribution amount of R500 000 over a lifetime.

• Growth in the investment does not count toward the contribution limits.

• There is no “roll-over” allowed for the annual limit (if the maximum amount of R 36 000 isn’t used in a particular year it won’t allow you to contribute more in the following year/s).

• You can contribute into multiple Tax-Free Investments, but the investor may only contribute up to a maximum of the annual and lifetime limits into the multiple Tax-Free Investments otherwise a tax penalty of 40% will be imposed on additions above these thresholds.

Withdrawals

Should you withdraw funds from the Tax-Free investments, you are not allowed to count these amounts as an addition to their future contribution limits. For example, if a person has contributed R200 000 to the Tax-Free investment and they decide to make a withdrawal of R100 000, they will still only ever be able to contribute a further R300 000 towards their Tax-Free investment in their lifetime.

On most investment platforms there are no penalties imposed on early withdrawals from the Tax-Free Investment. The Tax-Free Investment will pay-out its market related value at the time of withdrawal.

On request the Tax-Free Investment value should be available.

For assistance with making the best decisions on how to save and invest your money in the most tax-efficient way, contact Albert at the Securitas Financial Group on 076 087 3084 or albert@securitas.co.za.